A Flexible Spending Account (FSA) can be used for plastic surgery if the procedure is medically necessary and prescribed by a healthcare professional. Cosmetic surgeries for purely aesthetic purposes may not qualify for FSA reimbursement. Individuals should verify eligibility with their FSA provider and adhere to IRS guidelines.

Wondering about financing your plastic surgery journey Curious minds often ask, “Can you use FSA for plastic surgery?” The answer lies in understanding that FSA funds may cover medically necessary procedures, but not all cosmetic surgeries. Dive into your FSA provider’s guidelines to explore whether your desired plastic surgery qualifies for financial support.

The key factor is the medical necessity of your chosen procedure. Check with your FSA provider to ensure eligibility aligns with your aesthetic plans. Confirming this step ensures your FSA funds can contribute to your desired enhancement.

What is FSA?

A Flexible Spending Account (FSA) is a pre-tax savings account that allows employees to set aside a portion of their earnings to cover eligible medical expenses. This tax-advantaged benefit helps individuals save money on medical costs by using pre-tax dollars, reducing their overall taxable income.

FSA are often offered as part of employer-sponsored benefit packages and can be used for various healthcare expenses, including co-pays, prescription medications, and even certain over-the-counter items. It provides employees with a convenient way to manage healthcare costs and encourages proactive financial planning for medical needs throughout the year.

Can FSA be used for surgery?

Yes, Flexible Spending Accounts (FSAs) can typically be used to cover eligible surgical expenses. Qualified medical expenses under an FSA often include a wide range of medical procedures, and surgeries are generally considered eligible. This can encompass various types of surgeries, such as elective procedures, necessary surgeries, or other medically prescribed interventions.

It’s essential to check the specific guidelines and regulations of your FSA plan, as different plans may have slightly different rules regarding eligible expenses. Additionally, obtaining documentation from your healthcare provider, such as a prescription or a letter of medical necessity, may be required to substantiate the use of FSA funds for surgical expenses.

Can I buy Botox with my FSA?

Since Botox is often used for medical purposes, it qualifies as an eligible expense under FSA guidelines. However, it’s essential to check with your FSA administrator and healthcare provider to ensure compliance with specific regulations.

Individuals looking to use their FSA funds for Botox treatments should consult their FSA plan documents for clarity. Many FSAs cover Botox expenses if prescribed for medical reasons, such as migraine treatment or certain medical conditions.

What can I use FSA money for?

Flexible Spending Account (FSA) funds can be used for a variety of eligible medical expenses. Here are some common items and services that you can typically use FSA money for:

- Prescription Medications

FSA funds can be used to pay for prescribed medications.

- Over-the-counter (OTC) Medications

Some OTC medications are eligible for FSA reimbursement, but recent regulations require a prescription for reimbursement. Check with your FSA administrator for specific guidelines.

- Medical Office Visits

Co-pays and fees for doctor’s visits, specialists, or urgent care are eligible expenses.

- Dental Care

Expenses related to dental treatments, including cleanings, fillings, and orthodontia, are generally covered.

- Vision Care

Eye exams, prescription eyeglasses, contact lenses, and solutions are eligible expenses.

- Medical Procedures

Many medical procedures and surgeries are covered by FSA funds, but it’s essential to check with your FSA administrator for specific details.

- Medical Supplies

Items such as crutches, bandages, and diagnostic devices are typically eligible for reimbursement.

- Mental Health Services

Therapy sessions and counseling services may be covered under your FSA.

- Chiropractic Care

Expenses related to chiropractic treatments are often eligible for FSA reimbursement.

- Smoking Cessation Programs

Some programs designed to help individuals quit smoking may be covered.

What is Botox?

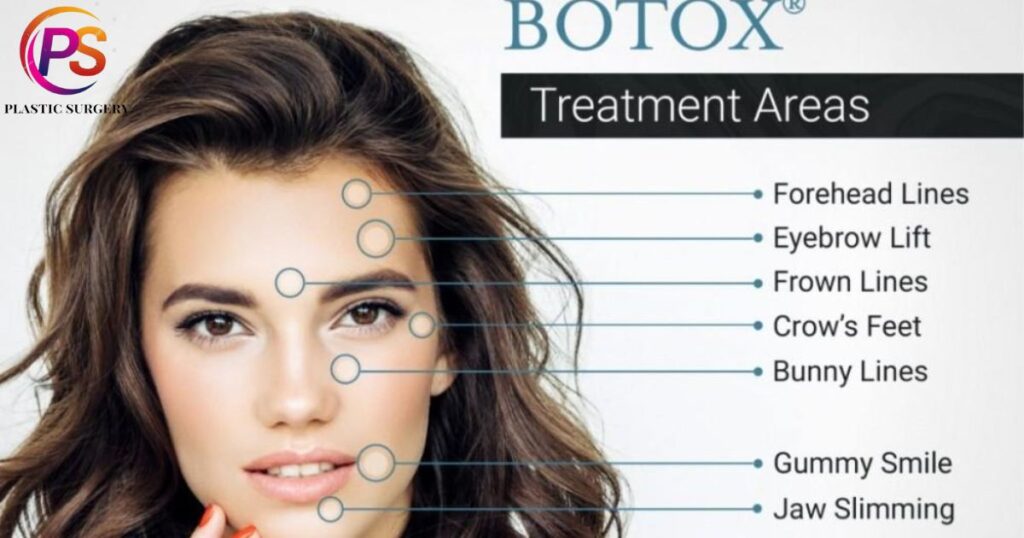

Botox, derived from the bacterium Clostridium botulinum, is a neurotoxic protein known for its medical and cosmetic applications. In the medical realm, Botox is employed to treat various conditions, including chronic migraines, muscle spasms, and cervical dystonia, offering therapeutic relief by temporarily paralyzing or weakening targeted muscles. In the cosmetic field, Botox injections are widely utilized to diminish the appearance of wrinkles and fine lines on the face.

Administered by qualified healthcare professionals, these injections temporarily disrupt nerve signals, resulting in a smoother, more youthful complexion. While Botox is generally safe when used appropriately, it’s crucial to seek treatment from skilled practitioners to ensure both effectiveness and safety in its applications.

Can I use my FSA for Botox if it is medically necessary?

Individuals with a Flexible Spending Account (FSA) may be able to use their funds for Botox treatments if prescribed for medical reasons. Conditions such as chronic migraines, muscle spasms, or certain neurological disorders may warrant Botox as part of a therapeutic plan. To utilize FSA funds for Botox, it is crucial to consult both the FSA administrator and the prescribing healthcare professional to ensure that the treatment aligns with FSA guidelines.

Keeping proper documentation, such as a prescription or a letter of medical necessity, is essential for reimbursement. It’s advised to review the specific terms and conditions of the FSA plan to guarantee compliance with eligibility criteria and maximize the benefits of using FSA funds for medically necessary Botox treatments.

Can I use my FSA for cool sculpting?

CoolSculpting, a non-invasive fat reduction treatment, is generally not eligible for reimbursement with Flexible Spending Accounts (FSAs). FSAs typically cover medical expenses related to the diagnosis, cure, mitigation, treatment, or prevention of disease, and CoolSculpting is primarily considered a cosmetic procedure aimed at enhancing physical appearance rather than addressing a medical condition.

It’s crucial to consult your FSA administrator to confirm the specific eligibility criteria of your plan and ensure compliance with current regulations. Understanding the guidelines beforehand will help avoid any misunderstandings regarding the use of FSA funds for CoolSculpting treatments.

Can you use FSA for laser skin treatment?

The use of Flexible Spending Account (FSA) funds for laser skin treatments depends on the medical necessity of the procedure. If the laser treatment is deemed medically necessary to address a dermatological condition or a specific skin-related medical issue, it may be considered an eligible expense under an FSA.

However, purely cosmetic laser treatments that are elective and not medically required may not qualify for FSA reimbursement. To ensure eligibility and compliance with FSA guidelines, individuals should consult both their healthcare provider and FSA administrator, clarifying the medical purpose of the laser skin treatment.

Are there any FSA-approved cosmetic products?

Flexible Spending Accounts generally do not cover over-the-counter cosmetic products unless they are specifically prescribed by a healthcare professional for a medical purpose. Cosmetic products that are used for general beauty or personal care purposes are typically considered ineligible for FSA reimbursement.

However, some exceptions may exist for certain cosmetic products if they have a medical purpose and are prescribed by a healthcare provider. For example, if a dermatologist prescribes a specific skincare product to treat a skin condition or a side effect of a medical treatment, the cost of that prescribed product may be considered an eligible FSA expense.

Does my FSA cover cosmetic surgery?

Flexible Spending Accounts usually don’t cover cosmetic surgery for purely aesthetic reasons. FSAs are meant for medical expenses, and elective cosmetic procedures usually fall outside this scope. However, if cosmetic surgery is deemed medically necessary, such as for reconstructive purposes after an injury or to correct a congenital issue, it might be eligible for FSA coverage.

To know for sure, it’s best to check with both your healthcare provider and FSA administrator, to ensure that the surgery meets the necessary criteria for reimbursement. Always keep detailed records, including any prescriptions or medical necessity letters, to support your FSA claims and adhere to the specific regulations of your FSA plan.

Can You Use FSA For Plastic Surgery?

| Type of Plastic Surgery | Eligibility for FSA |

|---|---|

| Reconstructive Surgery (Medically Necessary) | Generally Eligible: If surgery addresses a medical need, such as reconstructing after an injury or correcting a congenital issue. |

| Cosmetic Surgery (Purely Aesthetic/Elective) | Usually Not Eligible: If the surgery is performed for aesthetic reasons and is elective, it may not qualify for FSA reimbursement. |

| Consult with the Healthcare Provider and FSA Administrator | Always advisable to confirm with both your healthcare provider and FSA administrator to determine eligibility and ensure compliance with FSA guidelines. |

Frequently Asked Question

Can I use my FSA for any type of plastic surgery?

The eligibility for plastic surgery expenses depends on the nature of the procedure. Reconstructive surgery that addresses medical needs is typically covered, while purely cosmetic and elective procedures may not qualify.

What is considered reconstructive surgery?

Reconstructive surgery involves procedures that correct medical issues, such as injuries or congenital abnormalities. Examples include surgeries for post-accident reconstruction or correcting birth defects.

Are there specific criteria for plastic surgery to be FSA-eligible?

Yes, the surgery should generally be medically necessary, addressing a health condition. Elective and cosmetic surgeries, done solely for aesthetic reasons, may not meet FSA criteria.

How can I confirm if my plastic surgery is eligible for FSA coverage?

To determine eligibility, consult with both your healthcare provider and FSA administrator. They can guide whether the surgery meets FSA reimbursement criteria.

What documentation do I need for FSA reimbursement of plastic surgery?

Keep detailed records, including any prescriptions or letters from your healthcare provider explaining the medical necessity of the surgery. This documentation is essential for supporting FSA reimbursement claims.

Conclusion

The eligibility of using Flexible Spending Account (FSA) funds for plastic surgery hinges on the medical necessity of the procedure. Reconstructive surgeries, addressing medical needs such as injuries or congenital conditions, are generally FSA-eligible. However, purely cosmetic and elective procedures may not meet the criteria for reimbursement. It is crucial to consult both your healthcare provider and FSA administrator to clarify the nature of the surgery and ensure compliance with FSA guidelines.

keeping detailed documentation, including prescriptions or letters from your healthcare provider, is essential to support any FSA reimbursement claims. Understanding the specific rules of your FSA plan is key to making informed decisions about using FSA funds for plastic surgery.

I’ve been doing plastic surgery for 8 years. I know how to make people look better. I’m good at it and like making sure my patients are happy.